The routine reveals the remaining stability however owed after every cost is created, and that means you learn how a lot you have got remaining to pay. To produce an amortization schedule using Excel, you should use the complimentary amortization calculator which is able to handle the kind of rounding necessary of the official installment timetable. You can utilize the free mortgage amortization routine for mortgages, automobile financing, customer loans, and loans. If you find yourself a tiny exclusive lender, you are able to install the commercial variation and use it to produce a repayment schedule giving for the debtor.

Loan Amortization Plan

Down Load

Licenses: private utilize (not for circulation or selling)

"No construction, no macros – simply an easy spreadsheet" – by Jon Wittwer

Different Variations

Description

This spreadsheet-based calculator produces an amortization plan for a fixed-rate loan, with recommended further money.

Begin by going into the complete amount borrowed, the yearly interest, the quantity of many years required to pay the loan, and just how regularly the payments must be generated. Then you can certainly try out various other fees circumstances such as for instance producing an additional repayment or a balloon repayment. Always see the related blog post to understand how exactly to pay off the loan early in the day and save money on interest.

The repayment frequency is annual, semi-annual, quarterly, bi-monthly, month-to-month, bi-weekly, or regular. Prices were curved on the nearest cent. The past fees try adjusted to take the total amount to zero.

Financing fees Schedules: The workbook also includes 2 other worksheets for standard loan cost tracking. The essential difference between both is because of exactly how unpaid interest are taken care of. In the first, outstanding interest try included with the balance (bad amortization). From inside the 2nd (the one found into the screenshot), outstanding interest try accumulated in another interest balance.

Note: In the two cases, the installment big date column is for guide merely. This spreadsheet deals with debts where computations commonly centered on payment big date. Start  to see the straightforward Interest Loan spreadsheet when you have a loan that accrues interest every day and cost big date matters.

to see the straightforward Interest Loan spreadsheet when you have a loan that accrues interest every day and cost big date matters.

Loan Amortization Schedule – Commercial Version

The industrial type enables you to use the spreadsheet inside loan or monetary consultative business. The spreadsheet isn’t password protected, which means you can see the data and customize the spreadsheet.

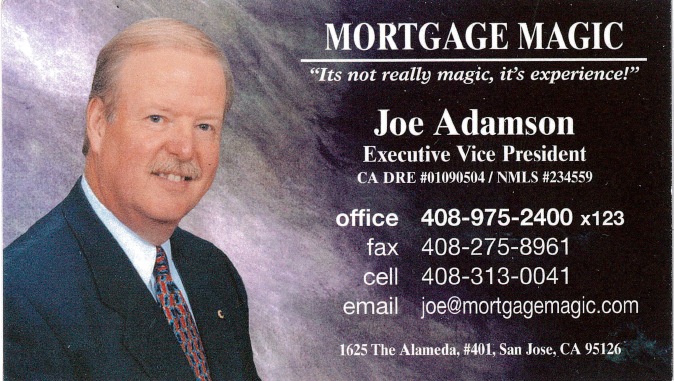

The header include a spot for any debtor’s title and lender’s tips: View Screenshot. You might customize the header to produce a "prepared by" section and include their logo design in the event that you wished: just click here to see an example.

The Vertex42 logo and copyright become outside the print area in order that they never appear once you print the plan.

60-DAY MONEY-BACK Guarantee

Try it out! Unless you envision it absolutely was worth the price, i shall refund your purchase.

Added Bonus #1 : Home Mortgage Calculator (Industrial Variation)

This will be a commercial utilize permit of your home loan Calculator spreadsheet. It allows one work an analysis on either a hard and fast rates or varying price financial.

Bonus no. 2 : Simple Interest Loan Calculator (Commercial Version)

This might be a commercial need license in our Simple Interest mortgage spreadsheet. It can be utilized to create a fees timetable for a Simple Interest Loan the spot where the interest accrues each day in a separate interest accrual account. In addition, it contains a worksheet for monitoring genuine repayments. This kind of loan is particularly a good choice for non-professional loan providers looking an easy and flexible strategy to keep track of costs. Find out about Easy Interest Debts,

Incentive number 3 : Interest-Only Loan Calculator (Industrial Version)

This can be a professional incorporate licenses of our own Interest-Only mortgage spreadsheet. It allows that create a fees schedule for a fixed-rate mortgage, with elective further money and an optional interest-only cycle.

Extra no. 4 : BETA – State-of-the-art Mortgage Installment Timetable

This spreadsheet produces a far more higher level way to monitor actual payments versus fees timetable part of the common mortgage Amortization timetable. You can use it to track overlooked money, belated money, very early repayments, costs, and escrow. It does not handle daily interest accrual like Bonus #2. It really is made to prevent negative amortization.